Where to Drop Off Supplies for Hurricane Harvey in Jacksonville

GOLD PRICE: UP $12.85 TO $1801.40

SILVER UP 29 CENTS TO $22.80

ACCESS PRICE CLOSING PRICES FOR GOLD AND SILVER

GOLD: 1803.70

SILVER: 22.80

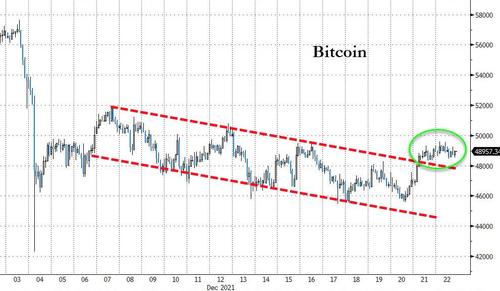

Bitcoin: morning price: 48,657 up $1313

Bitcoin: afternoon price: 48,995 up $1651

Platinum price: closing up $30.05 to $968.25

Palladium price; closing up $87.95 at 1885.10

END

end

DONATE

Click here if you wish to send a donation. I sincerely appreciate it as this site takes a lot of preparation.

Goldman Sachs stopped: 0

NUMBER OF NOTICES FILED TODAY FOR DEC. CONTRACT: 122 NOTICE(S) FOR 12200 OZ (0.3794 TONNES)

total notices so far: 34576 contracts for 3,457,600 oz

SILVER//DEC CONTRACT

191 NOTICE(S) FILED TODAY FOR 955,000 OZ/

total number of notices filed so far this month 8726 : for 43,600,000 oz

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

GLD

WITH GOLD UP $12.85

NO CHANGES IN GOLD INVENTORY AT THE GLD:

WITH RESPECT TO GLD WITHDRAWALS: (OVER THE PAST FEW MONTHS)

GOLD IS "RETURNED" TO THE BANK OF ENGLAND WHEN CALLING IN THEIR LEASES: THE GOLD NEVER LEAVES THE BANK OF ENGLAND IN THE FIRST PLACE. THE BANK IS PROTECTING ITSELF IN CASE OF COMMERCIAL FAILURE

ALSO INVESTORS SWITCHING TO SPROTT PHYSICAL (phys) INSTEAD OF THE FRAUDULENT GLD//

THIS IS A MASSIVE FRAUD!!

GLD 978,57 TONNES OF GOLD//

Silver//SLV

WITH NO SILVER AROUND AND SILVER UP 19 CENTS:

With silver up 29 cents today: a huge deposit into the SLV of 2.728 million oz/

A HUGE WITHDRAWAL OF 1.202 MILLION OZ FROM THE SLV/

INVESTORS ARE SWITCHING SLV TO SPROTT'S PSLV

CLOSING INVENTORY SLV/ TONIGHT: 538.883 MILLION OZ

Let us have a look at the data for today

SILVER//OUTLINE

SILVER COMEX OI ROSE BY A FAIR 523 CONTRACTS TO 141,119 AND CLOSER TO THE NEW RECORD OF 244,710, SET FEB 25/2020.. WITH THE $0.19 GAIN IN SILVER PRICING AT THE COMEX ON TUESDAY. OUR BANKERS WERE UNSUCCESSFUL IN KNOCKING THE PRICE OF SILVER DOWN (IT ROSE BY $0.19) AND WERE QUITE UNSUCCESSFUL IN KNOCKING OUT ANY SILVER LONGS AS WE HAD A STRONG GAIN OF 923 CONTRACTS ON OUR TWO EXCHANGES .

WE MUST HAVE HAD:

I) HUGE BANKER SHORT COVERING AS THEY ARE VERY ANXIOUS TO GET OUT OF DODGE!!/. II)WE ALSO HAD SOME REDDIT RAPTOR BUYING//. iii) A FAIR ISSUANCE OF EXCHANGE FOR PHYSICALS iiii) A HUGE INITIAL SILVER STANDING FOR COMEX SILVER MEASURING AT 47.535 MILLION OZ FOLLOWED BY TODAY'S 315,000 OZ QUEUE. JUMP V) FAIR SIZED COMEX OI GAIN.

I AM NOW RECORDING THE DIFFERENTIAL IN OI FROM PRELIMINARY TO FINAL:

THE DIFFERENTIAL FROM PRELIMINARY OI TO FINAL OI SILVER TODAY: CONTRACTS -62

HISTORICAL ACCUMULATION OF EXCHANGE FOR PHYSICALS DEC 16 ACCUMULATION FOR EFP'S SILVER/JPMORGAN'S HOUSE OF BRIBES/STARTING FROM FIRST DAY/MONTH OF DEC:

TOTAL CONTACTS for 17 days, total contracts: 15,364 or …average per day: 903 contracts or 4.518 million oz per day.

TOTAL NO OF OZ UNDERGOING EFP TO LONDON 15,364 CONTRACTS X 5,000 PER CONTRACT:

EQUATES TO: 76.820 MILLION OZ

.

LAST 7 MONTHS TOTAL EFP CONTRACTS ISSUED IN MILLIONS OF OZ:

MAY 137.83 MILLION

JUNE 149.91 MILLION OZ

JULY 129.445 MILLION OZ

AUGUST: MILLION OZ 140.120

SEPT. 28.230 MILLION OZ//

OCT: 94.595 MILLION OZ

NOV: 131.925 MILLION OZ

RESULT: WE HAD A FAIR SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 523 WITH OUR 19 CENT GAIN SILVER PRICING AT THE COMEX// TUESDAY THE CME NOTIFIED US THAT WE HADA FAIR SIZED EFP ISSUANCE OF 400 CONTRACTS( 400 CONTRACTS ISSUED FOR MAR AND 0 CONTRACTS ISSUED FOR ALL OTHER MONTHS) WHICH EXITED OUT OF THE SILVER COMEX TO LONDON AS FORWARDS THE DOMINANT FEATURE TODAY:/ AS WELL AS TODAY /HUGE BANKER SHORT COVERING AS THEY GET OUT OF DODGE//// WE HAVE A GOOD INITIAL SILVER OZ STANDING FOR DEC OF 47.535 MILLION OZ FOLLOWED BY TODAY'S 315,000 QUEUE JUMP .. WE HAD STRONG SIZED GAIN OF 923 OI CONTRACTS ON THE TWO EXCHANGES FOR 4.615 MILLION OZ//

WE HAD 191 NOTICES FILED TODAY FOR 955.000 OZ

GOLD//OUTLINE

IN GOLD, THE COMEX OPEN INTEREST FELL BY A SMALL SIZED 1160 CONTRACTS TO 500,846, AND FURTHER FROM OUR NEW RECORD (SET JAN 24/2020) AT799,541 AND PREVIOUS TO THAT:(SET JAN 6/2020) AT 797,110.

THE DIFFERENTIAL FROM PRELIMINARY OI TO FINAL OI IN GOLD TODAY. 1118 CONTRACTS.

THE SMALL SIZED DECREASE IN COMEX OI CAME WITH OUR LOSS IN PRICE OF $7.65//COMEX GOLD TRADING/TUESDAY/.AS IN SILVERWE MUST HAVE HAD HUGE BANKER/ALGO SHORT COVERING ACCOMPANYING OUR FAIR SIZED EXCHANGE FOR PHYSICAL ISSUANCE. WE HAD ZERO LIQUIDATION AS THE TOTAL GAIN ON OUR TWO EXCHANGES TOTALLED A SMALL SIZED 1279 CONTRACTS…

WE ALSO HAD A HUGE INITIAL STANDING IN GOLD TONNAGE FOR DEC AT 98.000 TONNES, FOLLOWED BY TODAY'S STRONG QUEUE JUMP OF 54,300 OZ//, NEW STANDING 109/496 TONNES

YET ALL OF..THIS HAPPENED WITHOUR LOSS IN PRICE OF $7.65 WITH RESPECT TO MONDAY'S TRADING

WE HAD A TINY SIZED GAIN OF 161 OI CONTRACTS (0.500 PAPER TONNES) ON OUR TWO EXCHANGES

E.F.P. ISSUANCE

THE CME RELEASED THE DATA FOREFP ISSUANCEAND IT TOTALLED A SMALL SIZED 1321 CONTRACTS:

FORFEB 1321 ALL OTHER MONTHS ZERO//TOTAL: 1321

The NEW COMEX OI FOR THE GOLD COMPLEX RESTS AT 501,964.

IN ESSENCE WE HAVE A TINY SIZED INCREASE IN TOTAL CONTRACTS ON THE TWOCONTRACTS OF 161, WITH 1160 CONTRACTS DECREASED AT THE COMEX AND 1321 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN ON THE TWO EXCHANGES OF 161 CONTRACTS OR 0.500 TONNES.

CALCULATIONS ON GAIN/LOSS ON OUR TWO EXCHANGES

WE HAD A SMALL SIZED ISSUANCE IN EXCHANGE FOR PHYSICALS (1321) ACCOMPANYING THE SMALL SIZED LOSS IN COMEX OI (1160): TOTAL GAIN IN THE TWO EXCHANGES 161CONTRACTS. WE NO DOUBT HAD 1) HUGE BANKER SHORT COVERING ,2.) HUGE INITIAL STANDING AT THE GOLD COMEX FOR DEC. AT 98.000 TONNES/FOLLOWED BY TODAY'S QUEUE JUMP OF 54,300 OZ TO LONDON////NEW STANDING OF 109.496TONNES//. 3)ZERO LONG LIQUIDATION,4) SMALL SIZED COMEX OI LOSS 5) SMALL ISSUANCE OF EXCHANGE FOR PHYSICAL

SPREADING OPERATIONS(/NOW SWITCHING TO GOLD) FOR NEWCOMERS, HERE ARE THE DETAILS:

SPREADING LIQUIDATION HAS NOW COMMENCED AS WE HEAD TOWARDS THE NEW ACTIVE FRONT MONTH OF NOV.WE ARE NOW INTO THE SPREADING OPERATION OF GOLD

HERE IS A BRIEF SYNOPSIS OF HOW THE CROOKS FLEECE UNSUSPECTING LONGS IN THE SPREADING ENDEAVOUR;MODUS OPERANDI OF THE CORRUPT BANKERS AS TO HOW THEY HANDLE THEIR SPREAD OPEN INTERESTS: HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NOW INTO THE NON ACTIVE DELIVERY MONTH OF OCT HEADING TOWARDS THE ACTIVE DELIVERY MONTH OF NOV, FOR GOLD:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST STARTS TO RISE BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (DEC), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE."

HISTORICAL ACCUMULATION OF EXCHANGE FOR PHYSICALS IN 2021 INCLUDING TODAY

DEC

ACCUMULATION OF EFP'S GOLD AT J.P. MORGAN'S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF DEC : 38,974 CONTRACTS OR 3,897,400 oz OR 121.23TONNES (17 TRADING DAY(S) AND THUS AVERAGING: 2292 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 17 TRADING DAY(S) IN TONNES:121.23 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2020, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 121.23/3550 x 100% TONNES 3.40% OF GLOBAL ANNUAL PRODUCTION

ACCUMULATION OF GOLD EFP'S YEAR 2021 TO DATE

JANUARY: 265.26 TONNES (RAPIDLY INCREASING AGAIN)

FEB : 171.24 TONNES ( DEFINITELY SLOWING DOWN AGAIN)..

MARCH:.276.50 TONNES (STRONG AGAIN/

APRIL: 189..44 TONNES ( DRAMATICALLY SLOWING DOWN AGAIN//GOLD IN BACKWARDATION)

MAY: 250.15 TONNES (NOW DRAMATICALLY INCREASING AGAIN)

JUNE: 247.54 TONNES (FINAL)

JULY: 188.73 TONNES FINAL

AUGUST: 217.89 TONNES FINAL ISSUANCE.

SEPT 142.12 TONNES FINAL ISSUANCE ( LOW ISSUANCE)_

OCT: 141.13 TONNES FINAL ISSUANCE (LOW ISSUANCE)

NOV: 312.46 TONNES FINAL ISSUANCE//NEW RECORD!! (INCREASING DRAMATICALLY)//SIGN OF REAL STRESS//SURPASSING THE MARCH 2021 RECORD OF 276.50 TONNES OF EFP

DEC. 115,71 TONNES//INITIAL ISSUANCE

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP'S ARE BEING TRANSFERRED TO WHAT ARE CALLED SERIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP'S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE .

First, here is an outline of what will be discussed tonight:

1.Today, we had the open interest at the comex, in SILVER, ROSE BY A FAIR SIZED 523 CONTRACTS TO 141,119 AND CLOSER TO OUR COMEX RECORD //244,710(SET FEB 25/2020). THE LAST RECORDS WERE SET IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD TO THAT WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT:234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 4 1/2 YEARS AGO.

EFP ISSUANCE 400 CONTRACTS

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

MAR 400 ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 400 CONTRACTS. EFP'S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE COMEX OI GAIN OF 585CONTRACTS AND ADDTO THE 400 OI TRANSFERRED TO LONDON THROUGH EFP'S,

WEOBTAIN A STRONG SIZED GAIN OF 923 OPEN INTEREST CONTRACT FROM OUR TWO EXCHANGES.

THUS IN OUNCES, THE GAINON THE TWO EXCHANGES 4.615 MILLION OZ,

OCCURRED WITH OUR $0.19 GAIN IN PRICE.

1/COMEX GOLD AND SILVER REPORT

(report Harvey)

2 ) Gold/silver trading overnight Europe, Gold

(Peter Schiff, Egon von Greyerz///Matthew Piepenburg via GoldSwitzerland.com,

3. ASIAN AFFAIRS

i)WEDNESDAY MORNING/TUESDAY NIGHT

SHANGHAI CLOSED DOWN 2.51 PTS OR 0.09% //Hang Sang CLOSED UP 131.00 PTS OR 0.57% /The Nikkei closed UP 44.62 PTS OR 0.16% //Australia's all ordinaires CLOSED UP 0.21%/Chinese yuan (ONSHORE) closed UP 6.3711/Oil UP TO 71,16 dollars per barrel for WTI and UP TO 73.87 for Brent. Stocks inEurope OPENED MOSTLY GREEN //ONSHORE YUAN CLOSED UP AT 6.3711 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED UP ON THE DOLLAR AT6.3804:/ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING STRONGER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING STRONGER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

A)NORTH KOREA//USA/OUTLINE

b) REPORT ON JAPAN

OUTLINE

3 C CHINA

OUTLINE

4/EUROPEAN AFFAIRS

OUTLINE

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

OUTLINE

6.Global Issues

OUTLINE

7. OIL ISSUES

OUTLINE

8 EMERGING MARKET ISSUES

OUTLINE

COMEX DATA//AMOUNTS STANDING//VOLUME OF TRADING/INVENTORY MOVEMENTS

GOLD

LET US BEGIN:

THE TOTAL COMEX GOLD OPEN INTEREST FELL BY A SMALL SIZED 1160 CONTRACTS AND FURTHER FROM THE RECORD THAT WAS SET IN JANUARY/2020: {799,541 OI(SET JAN 16/2020)} AND PREVIOUS TO THAT: 797,110 (SET JAN 7/2020). AND THIS COMEX DECREASE OCCURRED WITH OUR LOSS OF $7.65 IN GOLD PRICING TUESDAY'SCOMEX TRADING. WE ALSO HAD A SMALL EFP ISSUANCE (1321 CONTRACTS). . THEY WERE PAID HANDSOMELY NOT TO TAKE DELIVERY AT THE COMEX AND SETTLE FOR CASH. LOOKS LIKE OUR BANKERS ARE FINALLY BAILING OUT

WE NORMALLY HAVE WITNESSED EXCHANGE FOR PHYSICALS ISSUED BEING SMALL AS IT JUST TOO COSTLY FOR THEM TO CONTINUE SERVICING THE COSTS OF SERIAL FORWARDS CIRCULATING IN LONDON. HOWEVER, MUCH TO THE ANNOYANCE OF OUR BANKERS, THE COMEX IS THE SCENE OF AN ASSAULT ON GOLD AS LONDONERS, NOT BEING ABLE TO FIND ANY PHYSICAL ON THAT SIDE OF THE POND, EXERCISE THESE CIRCULATING EXCHANGE FOR PHYSICALS IN LONDON AND FORCING DELIVERY OF REAL METAL OVER HERE AS THE OBLIGATION STILL RESTS WITH NEW YORK BANKERS. IT SEEMS THAT ARE BANKERS FRIENDS ARE EXERCISING EFP'S FROM LONDON AND NOW THEY ARE LOATHE TO ISSUE NEW ONES.

EXCHANGE FOR PHYSICAL ISSUANCE

WE ARE NOW MOVING TO THE ACTIVE DELIVERY MONTH OF DEC.. THE CME REPORTS THAT THE BANKERS ISSUED A SMALLSIZEDTRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS.,

THAT IS 1321EFP CONTRACTS WERE ISSUED: ;: , DEC : 0 & FEB. 1321 & ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 1321 CONTRACTS

WHEN WE HAVE BACKWARDATION, EFP ISSUANCE IS VERY COSTLY BUT THE REAL PROBLEM IS THE SCARCITY OF METAL AND IT IS FAR BETTER FOR OUR BANKERS TO PAY OFF INDIVIDUALS THAN RISK INVESTORS ESPECIALLY FROM LONDON STANDING FOR DELIVERY. THE LOWER PRICES IN THE FUTURES MARKET IS A MAGNET FOR OUR LONDONERS SEEKING PHYSICAL METAL. BACKWARDATION ALWAYS EQUAL SCARCITY OF METAL!

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: A SMALL SIZED 161 TOTALCONTRACTS IN THAT 1321LONGSWERE TRANSFERRED AS FORWARDS TO LONDON AND WE HAD A SMALL LOSS COMEX OI OF 1160 CONTRACTS..

// WE HAVE A STRONG AMOUNT OF GOLD TONNAGE STANDING FOR DEC (109.496),

HERE ARE THE AMOUNTS THAT STOOD FOR DELIVERY IN THE PRECEDING 9 MONTHS OF 2021:

NOV. 8.074 TONNES

OCT. 57.707 TONNES

SEPT: 11.9160 TONNES

AUGUST: 80.489 TONNES

JULY: 7.2814 TONNES

JUNE: 72.289 TONNES

MAY 5.77 TONNES

APRIL 95.331 TONNES

MARCH 30.205 TONNES

FEB. 113.424 TONNES

JAN: 6.500 TONNES.

TOTAL SO FAR THIS YEAR (JAN- NOV): 488.996 TONNES

THE BANKERS WERE SUCCESSFUL IN LOWERING GOLD'S PRICE ////(IT FELL $7.65)

BUT THEY WERESUCCESSFUL IN FLEECING ANY LONGS AS THE TOTAL GAIN ON THE TWO EXCHANGES REGISTERED 3.978 TONNES,ACCOMPANYING OUR HUGE GOLD TONNAGE STANDING FOR DEC (109.496 TONNES)…

WE HAD – 1118 CONTRACTS REMOVED FROM COMEX TRADES. THESE WERE REMOVED AFTER TRADING ENDED LAST NIGHT

NET GAIN ON THE TWO EXCHANGES 161 CONTRACTS OR 16100 OZ OR 0.500 TONNES

COMMODITY LAW SUGGESTS THAT COMMODITY FUTURES OPEN INTEREST SHOULD APPROXIMATE 3% OF TOTAL PRODUCTION. IN GOLD THE WORLD PRODUCES AROUND 3500 TONNES PER YEAR BUT ONLY 2200 TONNES ARE AVAILABLE FROM THE WEST (THUS EXCLUDING RUSSIA, CHINA ETC..WHO KEEP 100% OF THEIR PRODUCT.THUS IN GOLD WE HAVE THE FOLLOWING: 506,187 TOTAL OI CONTRACTS X 100 OZ PER CONTRACT = 50.61 MILLION OZ/32,150 OZ PER TONNE = 15.74 TONNES

Estimated gold volume today: 103,664 extremely poor

Confirmed volume on Friday: 142,141 contracts extremely poor

DEC 22

| Gold | Ounces |

| Withdrawals fromDealers Inventory in oz | nil oz |

| Withdrawals fromCustomer Inventory in oz | nil oz |

| Deposit to theDealer Inventory in oz | nilOZ |

| Deposits to theCustomer Inventory, in oz | nil |

| No of oz served (contracts) today | 122 notice(s)12,200 OZ0.3794 TONNES |

| No of oz to be served (notices) | 627 contracts 62700 oz 1.950 TONNES |

| Total monthly oz gold served (contracts) so far this month | 34,576 notices 3,457,600 OZ107.608 TONNES |

| Total accumulative withdrawals of gold from theDealersinventory this month | NIL oz |

| Total accumulative withdrawal of gold from theCustomerinventory this month | xxx oz |

DEC 22 COMEX INVENTORY MOVEMENTS//AMOUNTS STANDING

For today:

No dealer deposit 0

No dealer withdrawal 0

No customer deposit 0

zero customer withdrawal

ADJUSTMENTS 0

CALCULATIONS FOR THE AMOUNT OF GOLD STANDING FOR DECEMBER.

For the front month of DECEMBER we have an oi 749 stand for December. for a LOSS ONLY of 65 contracts. We had 608 notices filed on TUESDAY so we GAINED A HUGE 543 contracts or an additional 54,300 oz will stand for delivery in this very active delivery month of December as our bankers search out for badly needed physical gold over on this side of the pond.

JANUARY LOST 89 CONTRACTS TO STAND AT 2409

FEBRUARY LOST 2941 CONTRACTS TO 376,274

We had 122 notice(s) filed today for 12,200 oz FOR THE DEC 2021 CONTRACT MONTH

Today, 0 notice(s) were issued from J.P.Morgan dealer account and 0 notices were issued from their client or customer account. The total of all issuance by all participants equates to 122 contract(s) of which 0 notices were stopped (received) by j.P. Morgan dealer and 31 notice(s) was (were) stopped/ Received) by J.P.Morgan//customer account and 0 notice(s) received (stopped) by the squid (Goldman Sachs)

To calculate the INITIAL total number of gold ounces standing for the DEC /2021. contract month,

we take the total number of notices filed so far for the month (34,576) x 100 oz , to which we add the difference between the open interest for the front month of (DEC: 749 CONTRACTS ) minus the number of notices served upon today 122 x 100 oz per contract equals 3,520,300,OZ OR 109.496 TONNES the number of TONNES standing in this active month of DEC.

thus the INITIAL standings for gold for the DEC contract month:

No of notices filed so far (35.203) x 100 oz+ (749) OI for the front month minus the number of notices served upon today (122} x 100 oz} which equals 3,466,000 ozstanding OR 109.496TONNES in this active delivery month of DEC.

This is a huge delivery for December.

We GAINED 543 contracts or an additional 54,300 oz WILL STAND FOR GOLD OVER HERE

TOTAL COMEX GOLD STANDING: 109.496 TONNES

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

COMEX GOLD INVENTORIES/CLASSIFICATION

NEW PLEDGED GOLD:

206,468.649, oz NOW PLEDGED /HSBC 6.42 TONNES

174,041.813 PLEDGED MANFRA 5.41 TONNES

54,339.114oz PLEDGED JPMorgan no 1 1.690

288,481,604, oz JPM No 2 8.97 TONNES

698,821.330 oz pledged June 12/2020 Brinks/27,96 TONNES

12,244.444 oz International Delaware: 0..3808 tonne

Loomis: 18,615.429 oz

total pledged gold: 1,653,017.372oz 51.42 tonnes

TOTAL REGISTERED AND ELIZ GOLD AT THE COMEX: 33,644.673.974 OZ (1046.458 TONNES)

TOTAL ELIGIBLE GOLD: 16,045,346.758 OZ

TOTAL OF ALL REGISTERED GOLD: 17,744,327.216 OZ

REGISTERED GOLD THAT CAN BE SERVEDUPON: 16,091,319 OZ (REG GOLD- PLEDGED GOLD)

I have compiled data with respect to registered (or dealer) gold taken on first day notice for each of the past 24 months

The data begins on first day notice for the May month taken on the last day of July 2018. and it continues to present day.

I then took, how many deliveries were recorded by the CME for each and every month. I also included for reference the price of gold on first day notice.

The first graph is a logarithmic graph and the second graph, linear.

You can see the huge explosion of registered gold at the comex along with deliveries. THE DATA AND GRAPHS:

END

SILVER COMEX DEC 22/2021

And now for the wild silver comex results

INITIAL STANDING FOR SILVER//DEC

| Silver | Ounces |

| Withdrawals fromDealers Inventory | NIL oz |

| Withdrawals from Customer Inventory | 798,501.608 oz HSBCManfra |

| Deposits to theDealer Inventory | 574,739.969 ozOZManfra |

| Deposits to the Customer Inventory | nil oz |

| No of oz served today (contracts) | 191CONTRACT(S) 955,000 OZ) |

| No of oz to be served (notices) | 363 contracts (1,815,000 oz) |

| Total monthly oz silver served (contracts) | 8726 contracts43,630,000 oz) |

| Total accumulative withdrawal of silver from theDealersinventory this month | NIL oz |

| Total accumulative withdrawal of silver from theCustomerinventory this month |

we had 1 deposits into the dealer

Into Manfra: 574,739.969 oz

total dealer deposits: 574,739.969 oz

i) We had 0 dealer withdrawal

total dealer withdrawals: nil oz

We had 0 deposits to the customer account:

JPMorgan has a total silver weight: 184.665 million oz/356.804 million =51.75

TOTAL REGISTERED SILVER: 93.205 MILLION OZ

TOTAL REG + ELIG. 356.581 MILLION OZ

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

silver open interest data:

Total oi for the silver complex: 141,119 contracts GAINING 585 contracts on the day

FRONT MONTH OF DEC OI: 554 CONTRACTS GAINING 63 contracts on the day.

TOTAL NO OF CONTRACTS SERVED UPON THIS MONTH: 8726 CONTRACTS FOR 43,630,000 OZ

CALCULATION OF SILVER OZ STANDING FOR DECEMBER

For the front month of DECEMBER we have an amount of silver standing AT 554 CONTRACTS for a GAIN of 63 contracts. We had 0 notices filed on TUESDAY, so we GAINED 63 contracts or an additional 315,000 oz will stand for delivery in this very active delivery month of December. There is surely no silver on either side of the pond.

JANUARY GAINED 143 CONTRACTS TO STAND AT 2289

FEBRUARY GAINED 16 CONTRACTS TO STAND AT 52

NUMBER OF NOTICES FILED TODAY: 191 NOTICES OR 955,000 OZ

Comex volumes: 33,055 poor (est. today)

Comex volume: confirmed Monday: 49,182 contracts (poor)

To calculate the number of silver ounces that will stand for delivery in DEC. we take the total number of notices filed for the month so far at 8726 x 5,000 oz =. 43,630,000 oz

to which we add the difference between the open interest for the front month of DEC (554) and the number of notices served upon today 191 x (5000 oz) equals the number of ounces standing.

Thus the standings for silver for the DEC./2021 contract month: 8726 (notices served so far) x 5000 oz + OI for front month of DEC (554) – number of notices served upon today (191) x 5000 oz of silver standing for the DEC contract monthequates 45,445,000 oz. .

WE GAINED 63 CONTRACTS OR AN ADDITIONAL 315,000 OZ WILL STAND FOR DELIVERY

the record level of silver open interest is 234,787 contracts set on April 21./2017 with the price at that day at $18.42. The previous record was 224,540 contracts with the price at that time of $20.44

END

GLD AND SLV INVENTORY LEVELS:

GLD

DEC 22/WITH GOLD UP $12.85 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 978.57 TONNES

DEC 21/WITH GOLD DOWN $7.05 TODAY, NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 978.57 TONNES

DEC 20/WITH GOLD DOWN $9.65 TODAY; A BIG CHANGES IN GOLD INVENTORY AT THE GLD: A DEPOSIT OF 1.37 TONNES INTO THE GLD///INVENTORY RESTS AT 977.20 TONNES

DEC 17/WITH GOLD UP $7.05 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 977.20 TONNES

DEC 16/WITH GOLD UP $33.05TODAY; A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 3.4 TONNES FROM THE GLD////INVENTORY REST AT: 977.20 TONNES

DEC15/WITH GOLD DOWN $7.80 TODAY/ A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 2.04 TONNES FROM THE GLD////INVENTORY RESTS AT 980.60 TONNES.

DEC 14/WITH GOLD DOWN $18.00 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 982.64 TONNES

DEC 13/WITH GOLD UP $3.20 TODAY/NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 982.64 TONNES

DEC 10.WITH GOLD UP $7.30 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 982.64 TONNES

DEC 9/WITH GOLD DOWN $9.10 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 982.64.

DEC 8/WITH GOLD UP $5.50 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 984.38 TONNES

DEC 7/WITH GOLD UP $5.15 TODAY; A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 1.74 TONNES OF GOLD FROM THE GLD////INVENTORY RESTS AT 984.38 TONNES

DEC 6/WITH GOLD DOWN $3.90 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 986.17 TONNES//

DEC 3/WITH GOLD UP $20.35 TODAY; A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 3.85 TONNES FROM THE GLD///INVENTORY RESTS AT 986.17 TONNES

DEC 2/WITH GOLD DOWN $19.80 TODAY; A HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A WITHDRAWAL OF 2.83 TONNES FROM THE GLD///INVENTORY RESTS AT 990.82 TONNES

DEC 1/WITH GOLD UP $7.05 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 992.85 TONNES

NOV 30/WITH GOLD DOWN $8.70 TODAY; NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESS AT 992.85 TONNES.

NOV 29/WITH GOLD DOWN $3.40 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD/INVENTORY RESTS AT 992.85 TONNES/

NOV 26/WITH GOLD UP $2.70 TODAY/A HUGE CHANGES IN GOLD INVENTORY AT THE GLD: A DEPOSIT OF 1.76 TONES INTO THE GLD////INVENTORY RESTS AT 992.85 TONNES

NOV 24/WITH GOLD UP $.40 TODAY//NO CHANGES IN GOLD INVENTORY AT THE GLD..INVENTORY RESTS AT 991.11 TONNES

NOV 23/WITH GOLD DOWN $21.85 TODAY: A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A DEPOSIT OF 6.11 TONNES INTO THE GLD////INVENTORY RESTS AT 991.11 TONNES.

NOV 22/WITH GOLD DOWN 54.10 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 985.00 TONNES

NOV 19/WITH GOLD DOWN $9.40 TODAY: A HUGE CHANGE IN GOLD INVENTORY AT THE GLD: A DEPOSIT OF 8.13 TONNES INTO THE GLD//INVENTORY RESTS AT 985.00 TONNES.

NOV 18/WITH GOLD DOWN $8.40 TODAY:A SMALL CHANGE IN GOLD INVENTORY AT THE GLD: A DEPOSIT OF .88 TONNES OF GOLD INTO THE GLD///INVENTORY RESTS AT 976.87 TONNES

NOV 17/WITH GOLD UP $14.10 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 975.99 TONNES

NOV 16/WITH GOLD DOWN $10.30 TODAY; NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY RESTS AT 975.99 TONNES

NOV 15/WITH GOLD DOWN $1.55 TODAY: NO CHANGES IN GOLD INVENTORY AT THE GLD//INVENTORY AT 975.99 TONNES//

XXXXXXXXXXXXXXXXXXXXXXXXX

Inventory rests tonight at:

DEC 21/ GLD INVENTORY 978.57 tonnes

Now the SLV Inventory/( vehicle is a fraud as there is no physical metal behind them

DEC 22/WITH SILVER UP 29 CENTS TODAY; A HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 1.202 MILLION OZ FROM THE SLV////INVENTORY RESTS AT 538.883 MILLION OZ/

DEC 21/WITH SILVER UP 19 CENTS: A BIG CHANGE IN SILVER INVENTORY AT THE SLV: A DEPOSIT OF 2.728 MILLION OZ INTO THE SLV///INVENTORY RESTS AT 540.085 MILLION OZ

DEC 20/WITH SILVER DOWN 22 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 538.282 MILLION OZ

DEC 17/WITH SILVER UP 9 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV/INVENTORY RESTS AT 538.282 MILLION OZ//

DEC 16/WITH SILVER UP 91 CENTS TODAY; A HUGE CHANGE IN SILVER INVENTORY AT THE SLV// A WITHDRAWAL OF 3.33 MILLION OZ FROM THE SLV//INVENTORY REST AT 538.282 MILLION OZ

DEC 15WITH SILVER DOWN 38 CENTS TODAY; A HUGE CHANGE IN SILVER INVENTORY AT THE SLV/: A WITHDRAWAL OF 2.48 MILLION OZ FROM THE SLV///INVENTORY RESTS AT 541.612 MILLION OZ

DEC 14/WITH SILVER DOWN 38 CENTS TODAY; NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 543.092 MILLION OZ

DEC 13/WITH SILVER UP 11 CENTS TODAY; A HUGE CHANGES IN SILVER INVENTORY AT THE SLV:A WITHDRAWAL OF 3.561 MILLION OZ FROM THE SLV//INVENTORY RESTS AT 543.092 MILLION OZ//

DEC 10.WITH SILVER UP 19 CENTS TODAY; NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 546.653 MILLION OZ..

DEC 9/WITH SILVER DOWN 43 CENTS TODAY; A HUGE CHANGE IN SILVER INVENTORY AT THE SLV// A DEPOSIT OF 2.96 MILLION OZ INTO THE SLV///INVENTORY RESTS AT 546.653 MILLION OZ/

DEC 8/WITH SILVER DOWN 7 CENTS TODAY; NO CHANGE IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 543.693 MILLION OZ///

DEC 7/WITH SILVER UP 24 CENTS TODAY: NO CHANGE IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 543.693 MILLION OZ..

DEC 6/WITH SILVER DOWN 25 CENTS TODAY; A HUGE CHANGE IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 1.110 MILLION OZ FROM THE SLV///INVENTORY RESTS AT 543.693 MILLION OZ//

DEC 3/WITH SILVER UP 21 CENTS TODAY; A BIG CHANGE IN SILVER INVENTORY AT THE SLV:A WITHDRAWAL OF 3.199 MILLION OZ FROM THE SLV////INVENTORY RESTS AT 544.803 MILLION OZ//

DEC 2/WITH SILVER DOWN 6 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 548.002 MILLION OZ.

DECM 1/WITH SILVER DOWN 44 CENTS TODAY: A SMALL CHANGE IN SILVER INVENTORY AT THE SLV: A WITHDRAWAL OF 740,000 OZ FROM THE SLV////INVENTORY RESTS AT 548.002 MILLION OZ//

NOV 30/WITH SILVER DOWN 3 CENTS TODAY; A SMALL CHANGES IN SILVER INVENTORY AT THE SLV// A WITHDRAWAL OF .555 MILLION OZ FORM THE SLV//INVENTORY RESTS AT 548.742 MILLION OZ///

NOV 29/WITH SILVER DOWN 25 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 549.297 MILLION OZ//

NOV 26/WITH SILVER DOWN 36 CENTS TODAY; A HUGE CHANGES IN SILVER INVENTORY AT THE SLV: A DEPOSIT OF 2.038 MILLION OZ INTO THE SLV.//INVENTORY RESTS AT 549.297 MILLION OZ///

NOV 24/WITH SILVER UP 5 CENTS //NO CHANGE IN SILVER INVENTORY AT THE SLV..INVENTORY RESTS AT 547.261 MILLION OZ

NOV 23.WITH SILVER DOWN 81 CENTS TODAY: A HUGE CHANGE IN SILVER INVENTORY AT THE SLV/: A WITHDRAWAL OF 2.128 MILLION OZ FROM THE SLV///INVENTORY RESTS AT 547.261 MILLION OZ//

NOV 22/ WITH SILVER DOWN 47 CENTS TODAY; A BIG CHANGES IN SILVER INVENTORY AT THE SLV: A SURPRISE DEPOSIT OF 1.156 MILLION OZ INTO THE SLV///INVENTORY RESTS AT 549.389 MILLION OZ/

NOV 19/WITH SILVER DOWN 14 CENTS TODAY: NO CHANGES IN SILVER INVENTORY AT THE SLV//INVENTORY RESTS AT 548.233 MILLION OZ..

NOV 18/WITH SILVER DOWN 27 CENTS TODAY/ NO CHANGES IN SILVER STANDING AT THE SLV.//INVENTORY REST AT 548.233 MILLION OZ//

NOV 17/WITH SILVER UP 24 CENTS TODAY: NO CHANGES IN SILVER STANDING AT THE SLV//INVENTORY RESTS AT 548.233 MILLION OZ//

NOV 16/WITH SILVER DOWN 17 CENTS TODAY: NO CHANGES IN SILVER STANDING AT THE SLV//INVENTORY RESTS AT 548.233 MILLION OZ//

NOV 15/WITH SILVER DOWN 25 CENTS TODAY: NO CHANGES IN SILVER AT THE SLV/ INVENTORY RESTS AT 548.233 MILLION OZ

SILVER INVENTORY //SLV//538.883 MILLION OZ//

PHYSICAL GOLD/SILVER STORIES

PETER SCHIFF

Peter Schiff: Jim Rickards Is Wrong About Inflation And Cathie Wood "Believes Her Own Bullshit"

BY TYLER DURDEN

WEDNESDAY, DEC 22, 2021 – 01:45 PM

Submitted by QTR's Fringe Finance

On my latest podcast, and my last podcast of 2021, I had the pleasure of speaking with my favorite economist, Peter Schiff. Peter is an American libertarian, stock broker, financial commentator, and radio personality. He is CEO and chief global strategist of Euro Pacific Capital Inc.

I'm glad I got to talk to Peter because I wanted to get his take on a couple of things. First, I wanted to get his take on this week's interview with Jim Rickards, where Rickards asserts that inflation has hit its peak, that the price of gold may stagnate next year and that the dollar has to get weaker in order for gold to rise.

Schiff told me:

"I think he's probably wrong. I don't think he has as good an understanding of inflation as he thinks. Is there a chance 2022 inflation can clock in below the 7.2% we're likely to get for 2021? I mean, it's possible. It's not going to be anywhere near 2%, but could it be lower? It could, but I think there's as good a chance that it'll be higher – and 2023 will probably be higher than 2022. I think we're in the early stages of a rather substantial inflationary period."

He continued:

"Inflation is the increase in the money supply, which Rickards acknowledges, but he just for some reason doesn't think the money is out there. That money is out there and it's making its way into the real economy. Look at our trade deficits. This is all money that's being printed and being spent."

In addition, Peter talked about fund manager Cathie Wood at ARK Invest, who I wrote about yesterday for secretly changing the language in one of her investor letters where she predicts her future returns. Schiff said about Cathie Wood:

"I don't think she's like, lying. I think she actually believes her own bullshit.That's the problem. She's been put up on this pedestal and everybody thinks she's so smart because she did something really dumb and it paid off. She just bought the most overvalued crap, and in doing that, the price went up. And now she thinks she's so smart and she has believed her own press clippings. She's completely irrational. The lawyers need to realize that their lawsuits are going to come. Investors are going to say 'I put my money into this fund' because she basically guaranteed me I was going to make 30-40% a year…"

He continued, talking about her recent 40% annual gain estimates:

"You don't make those kinds of forward looking statements with that degree of certainty in the litigious environment like we have in the United States. You're just asking for trouble.I think to me it's almost a sign of desperation on her part. She sees her funds going down, she has to plug up these holes..."

I also wanted to get Peter's take on Democrats' inability to understand basic economics, something I have been harping on since President Biden shut down U.S. oil projects and then spent the first 6 months of his term wondering where high oil prices were coming from.

This government idiocy was exemplified this week in Tweets by Elizabeth Warren, who has been blaming inflationnoton big oil,noton big tech,but on big grocery. Didn't know there was a "big grocery" to fear in this country? Boy, were you wrong.

"Giant grocery store chains force high food prices onto American families while rewarding executives & investors with lavish bonuses and stock buybacks. I'm demanding they answer for putting corporate profits over consumers and workers during the pandemic," Warren Tweeted earlier this week.

Schiff responded:

"It's flawed for so many reasons. Corporations are private enterprises, they're owned by their shareholders, who have invested in those companies because they're trying to earn a return on their investment. Corporations are supposed to put their owners first! That being said, the way to maximize profits for shareholdersisto put your customers first, because if you don't, you're going to lose them!"

He continued:

"Why do you think we have the expression 'the customer is always right?' This is the beauty of capitalism. It's the government – when the government tries to put the customer first, you get a lousy experience.When you go to the Post Office or the DMV – that's what you get. Because they're not profit seeking companies and they couldn't give a damn about the customer."

Schiff adds:

"Stores have to rise their prices because their costs are going up! If they don't, they'll go out of business!"

I also wanted to ask Peter his thoughts on Joe Manchin mansion choosing to vote no on the Build Back Better bill. Just a couple days ago, I wrote an article called "Joe Manchin Saves America" that argued that Manchin's "no" vote was exactly what Democrats deserved – and exactly what was best for our country right now. Peter offered his thoughts on my podcast.

Finally, we discussed the idea of whether or not "bond vigilantes" can come out of the woodwork to force the Fed's hand in hiking rates. This is something I wrote about days ago, and also asked my recent guest Jack Boroudjian about.

"The Fed has killed the bond vigilantes," Schiff tells me.

As a reminder, my podcast listeners usually always get 10% off a subscription to my blog. For the holidays, I am extending a 20% off subscription price thatliterally never changes for as long as you have your subscription, regardless of inflation:Get 20% off forever

Finally, you can listen to my podcast with Peter, here, for free:

END

LAWRIE WILLIAM//,//Egon von Greyerz///Matthew Piepenburg via GoldSwitzerland.com,James RICKARDS

END

Important gold commentaries courtesy of GATA/Chris Powell

* * *

OTHER GOLD COMMENTARIES:

OTHER COMMODITIES/LUMBER

END

CRYPTOCURRENCIES/

With China outlawing Bitcoin, Bitcoin miners have now gone underground to mine the stuff. This requires a lot of electricity. And they cannot find them?

(Bitcoin Magazine)

China Is Mining Bitcoin Underground: Report

TUESDAY, DEC 21, 2021 – 09:40 PM

Submitted by Bitcoin Magazine

According to a report byCNBC, bitcoin miners have found ways to keep operating in China despite the country's comprehensive efforts to crack down on the industry.

China used to be the country with the most significant share of hashrate. But that began to change in May when Chinese authorities began cracking down on Bitcoin and bitcoin mining. The increased regulatory scrutiny led to tangible impacts on BTC miners and exchanges, which started limiting or putting an end to their activities. In under a month, the Chinese crackdown led ASIC maker Bitmain to stop sales, a sharp decline in Bitcoin's total hash rate, and an "ASIC exodus" to ensue as the bitcoin mining landscape began to change.Workers transferring cryptocurrency mining rigs at a farm in Sichuan province

By September, China had issued a complete ban on Bitcoin. Despite the prohibition, the peer-to-peer network saw nearly 145 Bitcoin nodes still running on Chinese soil after a few days. According to data from Bitrawr.com, there are currently 125 nodes in the Asian country. Similarly, it appears that not all bitcoin miners have fled China.

Ben, a Chinese miner, toldCNBC that he had gone underground, spreading his mining equipment across multiple locations to decrease the chances of being spotted on China's power grid. He has also taken steps to conceal his digital geographical footprint and go behind the meter, pulling electricity from small power sources unconnected to the country's larger grid.

"We never know to what extent our government will try to crack down…to wipe us out," Ben reportedly said.

The report said that as much as 20% of the world's bitcoin miners are estimated to still reside in China, scattered across the country in setups similar to Ben's. It cited a November report by Chinese cybersecurity company Qihoo 360, which estimates an average of 109,000 bitcoin mining IP addresses active in China daily. An estimate from Cambridge University, however, says there are no miners left in the Asian country.Workers transferring cryptocurrency mining rigs at a farm in Sichuan province

Whereas big miners quickly and effectively moved overseas into friendlier regulations in Kazakhstan and the U.S., medium-sized miners saw their hands tied. "They couldn't offload their equipment to recoup their losses, nor could they mine at full capacity again, because their electrical footprint is easy to pick out," per the report. But smaller miners could deploy their operations across small power grids in China and maintain part of the operations.

"Mining is no longer a big business" in China, another bitcoin miner toldCNBC. Instead, the miner said the activity is now scattered across the country, with "a couple thousand miners here, a couple thousand miners there. It's more like a sort of band-aid to make money to help move the miners out of the country."

According to the report, besides plugging into small power grids, far from government oversight, these smaller bitcoin miners often evade Chinese censorship by joining foreign mining pools willing to sign them up despite the ban and helping them uncover their activity.

END

Your early currency/gold and silver pricing/Asian and European bourse movements/ and interest rate settings WEDNESDAY morning 7:30 AM

ONSHORE YUAN: 6.3711

OFFSHORE YUAN: 6.3804

HANG SANG CLOSED UP 131.00 PTS OR 0.57%

2. Nikkei closed UP 44.62 PTS OR 0.16%

3. Europe stocks MOSTLY GREEN

USA dollar INDEX DOWN TO 96;32/Euro RISES TO 1.1306-

3b Japan 10 YR bond yield: RISES TO. +.063/ !!!!(Japan buying 100% of bond issuance)/Japanese yen vs usa cross now at 114.24/ THIS IS TROUBLESOME AS BANK OF JAPAN IS RUNNING OUT OF BONDS TO BUY./JAPAN 10 YR YIELD IS NOW TARGETED AT .11%/JAPAN LOSING CONTROL OF THEIR BOND MARKET//

3c Nikkei now JUST ABOVE 17,000

3d USA/Yen rate now well below the important 120 barrier this morning

3e WTI:: 71.10 and Brent: 73.87-

3f Gold UP/JAPANESE Yen UP CHINESE YUAN: ON -SHORE CLOSED UP// OFF- SHORE UP

3g Japan is to buy the equivalent of 108 billion uSA dollars worth of bond per month or $1.3 trillion. Japan's GDP equals 5 trillion usa./"HELICOPTER MONEY" OFF THE TABLE FOR NOW /REVERSE OPERATION TWIST ON THE BONDS: PURCHASE OF LONG BONDS AND SELLING THE SHORT END

Japan to buy 100% of all new Japanese debt and by 2018 they will have 25% of all Japanese debt. Fifty percent of Japanese budget financed with debt.

3h Oil UP for WTI and UP FOR Brent this morning

3i European bond buying continues to push yields lower on all fronts in the EMU. German 10yr bund RISES TO -.0.288%/Italian 10 Yr bond yield RISES to 1.04% /SPAIN 10 YR BOND YIELD RISES TO 0.46%…ITALIAN 10 YR BOND YIELD/GERMAN BUND: 1.33: DANGEROUS FOR THE ITALIAN BANKING SYSTEM

3j Greek 10 year bond yield RISES TO : 1.29

3k Gold at $1792.75 silver at: 22.63 7 am est) SILVER NEXT RESISTANCE LEVEL AT $30.00

3l USA vs Russian rouble; (Russian rouble UP 18/100 in roubles/dollar) 73.82

3m oil into the 71 dollar handle for WTI and 73 handle for Brent/

3n Higher foreign deposits out of China sees huge risk of outflows and a currency depreciation. This can spell financial disaster for the rest of the world/

JAPAN ON JAN 29.2016 INITIATES NIRP. THIS MORNING THEY SIGNAL THEY MAY END NIRP. TODAY THE USA/YEN TRADES TO114.24DESTROYING JAPANESE CITIZENS WITH HIGHER FOOD INFLATION

30 SNB (Swiss National Bank) still intervening again in the markets driving down the FRANC. It is not working: USA/SF this morning.9224as the Swiss Franc is still rising against most currencies. Euro vs SF1.0428 well above the floor set by the Swiss Finance Minister. Thomas Jordan, chief of the Swiss National Bank continues to purchase euros trying to lower value of the Swiss Franc.

USA 10 YR BOND YIELD: 1.476 UP 2 BASIS PTS

USA 30 YR BOND YIELD: 1.879 UP 2 BASIS PTS

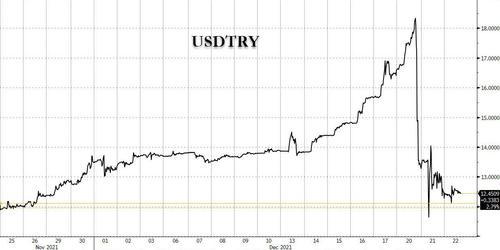

USA DOLLAR VS TURKISH LIRA: 12.48

Market Rally Fizzles As Volume Evaporates

WEDNESDAY, DEC 22, 2021 – 07:50 AM

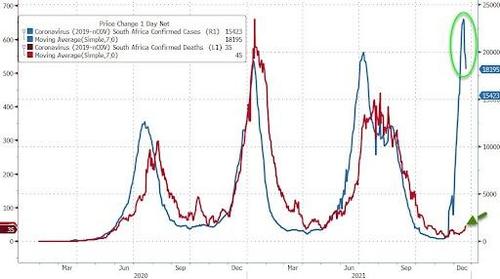

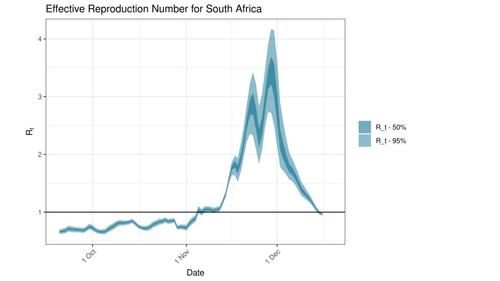

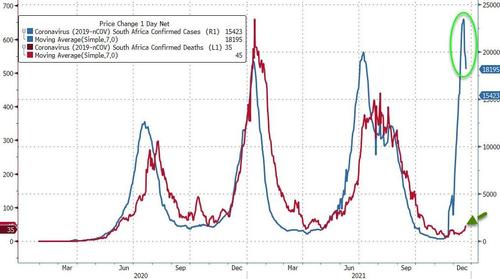

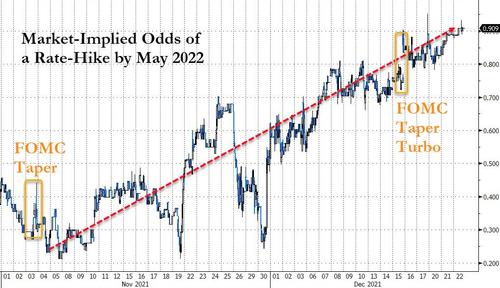

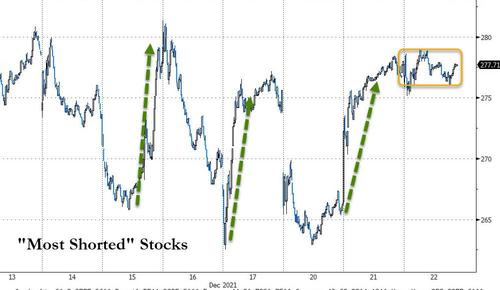

Tuesday's rally fizzled on Wednesday, as US emini futures were flat after erasing an earlier dip as attention again turned to news about the omicron variant as cases surged globally. Contracts on the Nasdaq 100 led declines, slipping 0.3% in thin trading ahead of holidays. In Europe, stocks were little changed as more omicron woes weighed on sentiment. Oil steadied as investors assessed mixed demand signals and the dollar fell. Elon Musk sold even more Tesla shares, one step close to his promise to sell 10% of his stake in the electric carmaker.

Markets have been volatile at the end of a year that has seen equities rally amid a recovery from the pandemic, before losing steam on worries about inflation, tighter policy and stricter curbs brought on by the omicron virus variant. Thinner trading volumes heading into the holidays could exacerbate market swings, leaving strategists reluctant to read much into day-to-day gyrations during the period.

"Despite the new restriction measures, many investors believe that omicron would only have a temporary impact on the economic activity and should not be a problem for the overall positive trend in equities," said Ipek Ozkardeskaya, senior analyst at Swissquote Group. "Investors should remain cautious with big ups and downs into the Xmas break."

In the latest Omicron news, the U.K. not planning new restrictions before Christmas, while Germany stopping short of a full lockdown while imposing tighter curbs. In the US, Joe Biden said Tuesday omicron will result in more breakthrough infections among vaccinated Americans, potentially in large numbers, but that they are very unlikely to be severely ill. The top medical adviser to the world's airlines said aircraft passengers are twice or even three times more likely to catch Covid-19 during a flight since the emergence of the variant.

"While this variant is significant and the impact is powerful, I do still have my rose-colored glasses heading into the New Year because below the surface there is still a lot of opportunity" away from trades that are played out or frothy, Nicole Webb, Wealth Enhancement Group senior vice president, said on Bloomberg Television.

Elsewhere, on the fiscal stimmy front, Biden said there's still a chance he can make a deal with Senator Joe Manchin to drive his economic plan through Congress.

In U.S. premarket trading, Tesla rose after Chief Executive Officer Elon Musk offloaded more of his stake in the electric-vehicle maker. Alibaba Group Holding Ltd. shares fell with other Chinese ADRs also coming under pressure, after local media reports that a unit's cooperation with a government agency has been suspended. Online marketplace operator JD.com dropped -2.3%, ride-hailing firm Didi -2.2%, Bilibili -2.5%. The Nasdaq Golden Dragon China Index of U.S.- listed Chinese companies has slumped 43% YTD amid worries over increasing regulatory oversight from both China and the U.S. Here are some other notable U.S. movers:

- Apple (AAPL US) slips 0.4% in U.S. premarket trading, easing after Tuesday's 1.9% bounce. The iPhone maker's shares have again outperformed the market this year and positive drivers remain ahead, Citi writes in note reiterating a buy rating and upping its target to $200 from $170.

- BlackBerry (BB US) shares fell 2.2% in U.S. premarket trading after the company's 4Q guidance disappointed, according to RBC Capital Markets.

- Tesla (TSLA US) shares gain 2.3% in U.S. premarket trading after CEO Elon Musk offloaded more of his stake in the electric-vehicle maker.

- Alibaba (BABA US) shares fall 3.2% in U.S. premarket trading, with other Chinese ADRs also coming under pressure, after local media reports that a unit's cooperation with a government agency has been suspended.

- Magnachip Semiconductor (MX US) buyback plan represents ~8.6% of the company's current market value, data compiled by Bloomberg show. The stock rose in postmarket trading.

- BioRestorative Therapies (BRTX US) rises as much as 70% in premarket trading after the company announced an agreement with contract research organization PRC Clinical for a phase 2 trial of its lead product.

- AAR (AIR US) drops 8.3% in postmarket trading after the aerospace product supplier reported second quarter earnings that trailed the average analyst estimate.

- Acasti Pharma's (ACST US) merger gives it "a diversified, late-stage, orphan drug pipeline and bench strength," writes Oppenheimer, launching coverage at outperform. Stock rallied 30% in postmarket.

- Repro Med Systems (KRMD US) gains 7.8% in postmarket trading after reporting the FDA cleared the expanded on-label use of the Freedom60 infusion system to two additional subcutaneous Ig medications, Cutaquig and Xembify.

Most European equities were little changed in notably subdued volatility with Spain's IBEX outperforming, rising 0.4%; FTSE MIB lags. Tech and travel are the best performing sectors, utilities slip over 1%. Elsewhere,European power climbed to a fresh record as France faces a winter crunch.

Asian equities rose, on track for a second-straight day of gains, as investors assessed progress in the U.S. administration's spending plans in thin trading ahead of year-end holidays. The MSCI Asia Pacific Index was up 0.3% as of 5:10 p.m. in Hong Kong, driven higher by consumer discretionary and IT shares. China's tech stocks advanced for a second day as traders rushed to unwind short bets ahead of the year-end holidays. Investors returned to riskier assets globally after Monday's selloff, as President Joe Biden said there's still a chance he can strike a deal with Senator Joe Manchin to get his Build Back Better economic plan through Congress. While rates are expected to climb in 2022 thanks to inflation and signaled hikes from the Federal Reserve, strategists expect the advance to top out in negative territory on an inflation-adjusted basis.

"Even as central banks look to tighten up monetary policy a little bit because inflation is high, people aren't looking at the bond market for an inflation hedge, that could still keep some attractiveness in the equity markets," Jason Schenker, president at Prestige Economics LLC, told Bloomberg Television. Benchmarks in India and Hong Kong rose the most in the region, while Japan's stocks edged higher. Singapore's Straits Times Index was down 0.1% as the country halted ticket sales for quarantine-free travel lanes.

Japanese equities closed slightly higher after swinging in a narrow range, as trading thinned heading into the year-end holidays. Gains in electronics makers offset losses in auto and food makers, pushing the Topix 0.1% higher. Tokyo Electron was the biggest contributor to a 0.2% gain in the Nikkei 225. Volumes on both gauges were more than 25% below 30-day averages

India's key indexes extended their rebound for a second day, tracking recoveries in regional peers, after the Nifty entered a correction earlier this week. The S&P BSE Sensex rose 1.1% to 56,930.56 in Mumbai, its biggest advance since Dec. 8. The NSE Nifty 50 Index also advanced by a similar measure. Reliance Industries was among the biggest contributors to both gauges. All 19 sector sub-indexes compiled by BSE Ltd. climbed, led by the realty group. The Nifty's two-day gain comes after the index entered a technical correction Monday, falling more than 10% from its record-high closing on Oct. 18, with the Sensex's earlier drop just short of that level. "Volumes would remain muted for the rest of December, since there are expected to be few triggers in terms of news flow," according to S. Hariharan, a sales trading head with Emkay Global Financial Services. He sees information-technology companies attracting interest from investors and bottom-fishing taking place in auto-related shares.

In rates, treasury yields rose modestly, led by the belly of the curve, and so did bund yields. The 10Y TSY traded at 1.4720% last. Gilts underperformed bunds and USTs, cheapening 3-4bps in a bear steepening move. Bunds and USTs bear flatten slightly. Much of the semi-core and peripheral space tightens to core; Italy underperforms, widening 1.5bps at the 10y point.

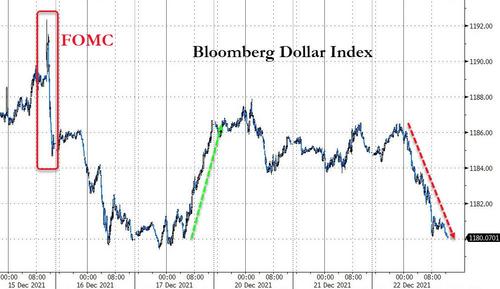

In FX, the Bloomberg Dollar Spot Index slipped as the greenback traded weaker versus most of its Group-of-10 peers. Risk-sensitive currencies, led by the Norwegian krone, performed best; the euro hovered in a narrow 1.1264-1.1300 range. The pound edged higher against the dollar after revised data showed the U.K. economy has recovered from the pandemic faster than previously thought; gilt yields rose by 4-5bps across the curve. The Australian and New Zealand dollars weighed down in early trade before recovering ground, as rising Covid cases spur concerns about the economic outlook. Prime Minister Scott Morrison is urging state and territory leaders to move ahead with reopening plans even as omicron outbreaks push daily infections to record levels. Aggressive bets on rate hikes by the RBA are receding with the yield on 3-year bonds down 8bps to 0.84%. The yen slipped; concerns over debt supply and gains in overnight overseas yields capped bond prices. The world's most volatile security, the Turkish lira, held a tight range near 12.51/USD.

In commodities, crude futures hold in the green. WTI trades up 0.5% near $71.50, Brent near $74.25. Spot gold is little changed near $1,788/oz. Most base metals are in the green: LME zinc and aluminum are up over 2%, tin lags.

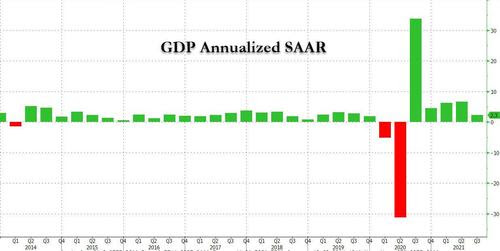

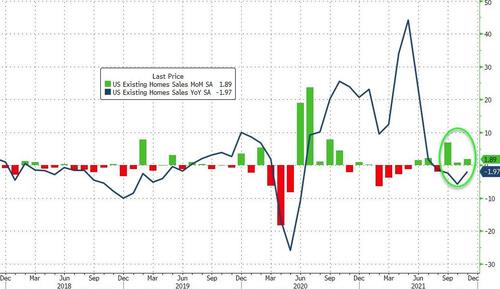

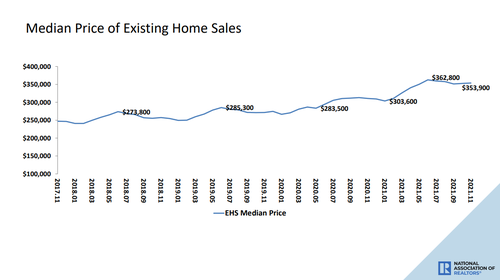

On today's calendar, we have the 2nd revision of Q3 GDP, the Conference Board sentiment index, and Existing home sales data.

Market Snapshot

- S&P 500 futures down 0.2% to 4,632.75

- STOXX Europe 600 up 0.2% to 474.88

- MXAP up 0.3% to 190.50

- MXAPJ up 0.5% to 617.81

- Nikkei up 0.2% to 28,562.21

- Topix little changed at 1,971.51

- Hang Seng Index up 0.6% to 23,102.33

- Shanghai Composite little changed at 3,622.62

- Sensex up 1.1% to 56,927.27

- Australia S&P/ASX 200 up 0.1% to 7,364.77

- Kospi up 0.3% to 2,984.48

- German 10Y yield little changed at -0.29%

- Euro down 0.1% to $1.1273

- Brent Futures up 0.4% to $74.30/bbl

- Gold spot down 0.1% to $1,788.23

- U.S. Dollar Index little changed at 96.54

Top Overnight news from Bloomberg

- "We are well aware of the uncertainty around our inflation projections. There is a risk to the upside," European Central Bank Executive Board member Isabel Schnabel says in interview with Le Monde

- It was supposed to be a year when volatility in the currency space would make a strong comeback as yield-starved investors from the world of bonds shifted focus to create alpha. Yet inflation made for such volatility in rates and equities, that FX found itself in relatively calm waters

- Anyone gearing up for bond yields to surge in 2022 should think again. A global glut of saved cash has the potential to restrain an increase in rates, even as central banks dial back their pandemic stimulus.

- In the months after Boris Johnson signed his post- Brexit trade deal with the European Union, the coronavirus masked the economic damage of leaving the bloc. As the pandemic drags on, the cost is becoming clearer — and voters are noticing

- U.K. employer confidence plunged to the lowest level since the nation was still under lockdown earlier this year as the spread of the omicron variant and uncertainty about inflation and labor shortages dimmed the outlook

- The green debt market is growing at a much faster pace than the real-world projects it was created to support, thanks to some financial engineering

- A Chinese regulator has tightened rules regarding use of messaging tools in the nation's local bond and derivative markets, clamping down on anonymous accounts following similar moves globally in recent years

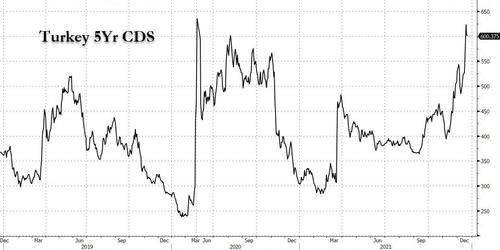

- For Turkish sovereign and corporate debt, Monday's emergency measures to tackle the lira's meltdown have come too late to rescue a painful 2021. Investors have lost 7.8% on the country's dollar-denominated sovereign debt this year, compared to 2.9% across emerging markets in the worst performance since 2013

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were indecisive overnight following the sharp rebound seen on Wall Street – which was spurred by the tech sector as Micron led the charge following solid earnings, whilst some reopening plays such as airlines and cruise lines saw substantial gains.The Russell 2000 saw gains of 2.9%, the Nasdaq rose 2.4% whilst the S&P 500 and DJIA closed higher by 1.8% and 1.6% respectively. US equity futures trade flat with a mild downside bias, whilst APAC stocks gradually trimmed earlier gains. The ASX 200 (+0.1) spent most of the session in modest negative territory, but gains in Tech cushioned losses. The Nikkei 225 (+0.1%) and KOSPI (+0.3%) opened with mild gains but the upside momentum petered out. The Hang Seng (+0.6%) initially outperformed amid a revival of large tech, with Alibaba, Tencent, NetEase and JD.com among the biggest gainers at one point. The Shanghai Comp (-0.1%) conformed to the indecisive tone, with the index caged to a tight range. US 10yr Treasury futures reflected the indecisiveness of markets overnight.

Top Asian News

- Defaulter Sinic Says Unlikely to Repay January Bonds, Coupon

- China's Xi Tells Lam Hong Kong Is Heading in the Right Direction

- Asian Stocks Extend Gains Slightly as Investors Tread Water

- Alibaba Shares, Chinese ADRs Drop in U.S. Premarket Trading

European bourses are essentially unchanged, with both the direction and magnitude of action in-fitting with the dull trading conditions seen overnight.Since the cash open, indices have meandered around the unchanged mark; there are modest regional differences but no convincing or enduring moves in either direction. Sectors are in the green, but the breadth of performance is contained with less than 1.0ppts separating the best and worst performers. News flow remains thin and focus continues to fall on COVID; albeit, the clamour for updates has slowed somewhat with the UK and US confirming no pre-Xmas restrictions, but the post-Xmas period remains uncertain. Individual movers include Delivery Hero (+6.5%) after updating on Foodpanda divestments, Rio Tinto (-1.3%) following the acquisition of Rincon Mining Lithium for USD 825mln.

Top European News

- U.K. to Say Omicron Causes Milder Disease Than Delta: Politico

- European Gas Drops After Surging on Constrained Russian Flows

- Cargill Inks $1 Billion Deal for Croda's Tech, Chemical Unit

- Delivery Hero Exits German Delivery Business in Reversal

In FX,newsflow and turnover is dwindling as the clock ticks down to Xmas, but the lack of depth in terms of trading volume is keeping price movement active or even lively for some financial market instruments and assets. Indeed, debt remains volatile and in the throes of a relatively pronounced, deep bull retracement, to the benefit of the Buck over lower yielders if not other rival currencies that are elevated or underpinned due to independent factors. As such, the Dollar index is holding around 96.500, and currently within a 96.361-604 range awaiting a decent line up of US data that may prompt a reaction and provide a fundamental distraction from the overriding focus on pandemic headlines/updates. Conversely, the Yen and Franc are lagging/underperforming, with the former now probing below its post-FOMC base and inching closer towards Fib support at 114.38, while the latter is trying to absorb more offers and soak up pressure at 0.9250.

- GBP – The Pound has bounced further from recent lows across the board in wake of confirmation from UK PM Johnson that no new Omicron/COVID measures will be imposed this side of Christmas rather than final UK GDP data for Q3 that was somewhat mixed. Cable is eyeing edging through.3300 and Eur/Gbp is straddling 0.8500 irrespective of hawkish sounding comments from ECB's Holzmann who suggests there may be an extreme case for a rate hike in 2022.

- NZD/CAD/AUD/EUR – Risk sentiment appears to have plateaued following Tuesday's significant revival in appetite, but the Kiwi, Loonie and Aussie have derived enough impetus to pare declines against the Greenback between 0.6773-40, 1.2924-04 and 0.7158-21 respective parameters, in keeping with crude, industrial and precious metals that are maintaining recovery momentum on the grounds that the latest pandemic waves might not be as damaging as prior episodes. Elsewhere, the Euro could be gleaning underlying support from decent option expiry interest at 1.1245-50 (1.3 bn) in the same vein as expiries capped the upside yesterday and on Monday, but the psychological 1.1300 level is still proving to be a tough hurdle even with the aforementioned ECB rhetoric.

- EM – A new day brings more angst between Russia and the US, though the Rub is firmer alongside Brent and the Nok, while the Cnh and Cny are both on an even keel after another firmer PBoC midpoint setting. In Turkey, the Try seems to have topped out with little response to the first CBRT repo by quantity auction at 14% in Lira 38bn, maturing on December 29 that came at an official rate of 12.348 vs the Usd for time deposits. Indeed, the pair has rebounded from close to 12.0000 and is now nearer the upper end of a band reaching 12.6600, largely taking comments from President Erdogan in stride as well. However, for the record he declared in typical forthright fashion that the country has thwarted all games against the domestic economy, adding more dramatically that those calling to buy FX (Usd) have now had their 'brains watered out' (or washed presumably!).

In commodities,WTI and Brent are modestly firmer in a continuation of the general trend of APAC trade, though the benchmarks remain within fairly narrow parameters. Prior to Tuesday's private inventory report, some modest downside was seen, and while the API's weekly inventory data reportedly showed a larger-than-expected build, the internals were more mixed. Today's EIA release is expected to print a headline draw accompanied by mixed internals. Currently, the benchmarks are steady towards the top-end of the sessions range which stands at under USD 1.0/bbl. Natural gas prices remain in focus as reports once again indicated that the Yamal-Europe pipeline is operating in reverse mode. However, UK prices were subdued, retracing some of the upside seen yesterday on the referenced pipeline activity. Moving to metals, spot gold and silver are contained and have been pivoting the unchanged mark for this most part. Separately, base metals are modestly firmer deviating slightly from APAC pressure in copper, for instance.

US Event Calendar

- 7am: Dec. MBA Mortgage Applications, prior -4.0%

- 8:30am: 3Q GDP Annualized QoQ, est. 2.1%, prior 2.1%

- 8:30am: 3Q PCE Core QoQ, est. 4.5%, prior 4.5%

- 8:30am: 3Q GDP Price Index, est. 5.9%, prior 5.9%

- 8:30am: 3Q Personal Consumption, est. 1.7%, prior 1.7%

- 8:30am: Nov. Chicago Fed Nat Activity Index, est. 0.40, prior 0.76

- 10am: Dec. Conf. Board Consumer Confidenc, est. 111.0, prior 109.5

- Expectations, prior 87.6

- Present Situation, prior 142.5

- 10am: Nov. Existing Home Sales MoM, est. 3.0%, prior 0.8%

3. ASIAN AFFAIRS

i)WEDNESDAY MORNING/TUESDAY NIGHT

SHANGHAI CLOSED DOWN 2.51 PTS OR 0.09% //Hang Sang CLOSED UP 131.00 PTS OR 0.57% /The Nikkei closed UP 44.62 PTS OR 0.16% //Australia's all ordinaires CLOSED UP 0.21%/Chinese yuan (ONSHORE) closed UP 6.3711/Oil UP TO 71,16 dollars per barrel for WTI and UP TO 73.87 for Brent. Stocks inEurope OPENED MOSTLY GREEN //ONSHORE YUAN CLOSED UP AT 6.3711 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED UP ON THE DOLLAR AT6.3804:/ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING STRONGER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING STRONGER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP RAISED RATES TO 25%

3 a./NORTH KOREA/ SOUTH KOREA

///NORTH KOREA

3B JAPAN

Just look at what supply issues have done to Japan. McDonald's rations fries

(zerohedge)

McDonald's Rations Fries As Supply Shortage Hits Japan

TUESDAY, DEC 21, 2021 – 08:40 PM

A 'fry-tening' supply chain problem has materialized for McDonald's Holdings Co. Japan is forcing it to ration french fries for at least a week due to a potatoes shortage.

Beginning on Friday, Japanese consumers desiring a classic Big Mac will be barred from ordering medium- and large-sized french fries. They will be only allowed to order small french fries as the company blames massive flooding in Vancouver for its soggy mess and attempts to source spuds elsewhere.

About 2,900 McDonald's restaurants in the country will experience french fry rationing for at least this week "to ensure that as many customers as possible will have continued access to our french fries," according to Bloomberg.

McDonald's believes the shortage will be resolved by New Year's eve, and said meals that come with medium fries will be reduced by 44 cents to reflect the smaller portion. It said the rationing wouldn't affect hash brown.

The popular fast-food company didn't quantify the financial impact of the french fry shortage.

This is the second time in three years, McDonald's has experienced a french fry shortage. Cold weather and the impact of a hurricane in 2019 damaged potato crops across North America and led to supply woes for french fry processors.

The latest french fry shortage is an example of fragile global supply chains as weather volatility increases.

end

3B CHINA

China is imploding. They now are fining media stars huge money for "exploiting tax loopholes(zerohedge)

TUESDAY, DEC 21, 2021 – 10:40 PM

Beijing's ongoing housecleaning of all things deemed anti-revolutionary by the principles of President Xi Jinping Thought has once again circled back to social media influencers, a class of business that, like video games, private tutoring, and the technology industry more broadly, is being shaken down for presenting a threat to the CCP's rule.

The latest crackdown involves China's ballooning live streaming business by targeting the individual streamers themselves, according to Bloomberg. On Monday,the State Taxation Administration fined Viya, a top live-streamer, $210MM, and accused her of concealing personal income and making false declarations in 2019 and 2020. It comes after authorities last month fined two live-streamers in Hangzhou nearly $15MM in total for allegedly illegally booking employment income as business income.

The punishments mark what BBG described as"an escalation in President Xi Jinping's campaign against illegal sources of income as part of China's 'common prosperity' drive that aims to narrow the wealth gap." We can't help but wonder ifthey submitted that language to the CCP censors for approval ahead of time. We notice also that there is no byline attached to the story, suggesting that none of the reporters responsible for writing it wanted to take the credit.

This is hardly the first celebrity to be targeted for retaliation by the CCP. Celebrities have been targeted by tax authorities, largely as a pretext for promoting values that the CCP sees as antithetical to its interests. Bloomberg described it as the "improper" idol culture.

And there's of course the issue of tennis star Peng Shuai, who recently recanted her sexual assault accusations against a top CCP member.But we're sure that's all a coincidence, right?

Tax authorities have asked celebrities to report their wrongdoings in exchange for lighter punishment starting in September after announcing new tax checks. More than 1,000 live-streamers and other workers affected have reportedly paid back taxes since then, per the CCP.

Viya, also known as Huang Wei, issued an apology after the punishment was announced. She said on her Weibo account that she felt "deeply guilty" and would pay the fines by the deadline.

Her colleagues better pony up quick. Before it's too late.

end

4/EUROPEAN AFFAIRS

END

EUROPE//COVID VACCINE MANDATE

Now getting pretty bad! EU now sets for a 9 month expiration rate for vaccine passports.

(zerohedge)

EU Sets 9-Month Expiration Date For Vaccine Passports

WEDNESDAY, DEC 22, 2021 – 04:15 AM

COVID case numbers are already starting to decline in southern Africa, seen as the epicenter of the omicron explosion, but that hasn't stopped the EU from further tightening restrictions related to travel.

Because according to Reuters, the European Commission on Tuesday agreed to new rules that will make the EU's COVID vaccine travel passport (what they call a "travel certificate") will be valid for nine months after the completion of the "primary vaccination schedule" – which right now only includes the first two doses.

The new rules will be binding for all 27 member states starting Feb. 1.

The decision, made by the bloc's governing commission, which has purview over issues related to intra-bloc travel, comes just as Germany's Robert Koch Institute, the primary source of public health policy, recommended on Tuesday that"maximum contact restrictions" should be imposed, starting immediately, to combat a looming tide of infections caused by this latest winter wave (to which the new omicron variant is now contributing).

As for the new EU-wide travel rules, they will replace a non-binding recommendation the EU Commission put forward in November.

Also, it's worth pointing out that the nine month timeline leaves the door open for the EU to require boosters, potentially as often as every six or nine months.

Interestingly enough, Reuters also pointed out thattravel measures restricting intra-bloc travel being imposed by a smattering of individual member states are helping to undermine the authority of the EU Commission. But the pass does leave room for governments to impose restrictions on indoor events and activities within their respective territories.

Still, once the new rule is in place,EU member states will in theory be obliged to let fully vaccinated travelers with a valid pass access their territory.Though they still could – as an exception justified by a deteriorating situation – impose further requirements, such as negative tests or quarantines, as long as they are proportionate.

END

AUSTRIA

Austria hiring people to hunt down vaccine refusers.

This is really bad!

(Watson/SummitNews)

Austria Hiring People To "Hunt Down Vaccine Refusers"

WEDNESDAY, DEC 22, 2021 – 03:30 AM

Authored by Paul Joseph Watson via Summit News,

The Austrian government is hiring people to "hunt down vaccine refusers," according to a report published by Blick.

Yes, really.

The burden for enforcing the fines unjabbed Austrians will have to pay as part of their punishment will fall to their employers, necessitating a new army of 'inspectors' to ensure that process is running smoothly.

The city of Linz, which is home to 200,000 inhabitants, has a relatively low vaccination rate of 63 per cent.

In response, "Linz now wants to hire people who are supposed to hunt down vaccine refusers," reports Swiss news outlet Blick.

The role of the inspectors will be to check on "whether those who do not get vaccinated really pay for it."

The vaccine refusenik hunters will receive a wage of 2774 euros, which will be paid 14 times a year, making an annual income of 38,863 euros.

Nice work if you can get it.

"The job includes, among other things, the creation of penal orders as well as the processing of appeals," according to the report, adding that workers need to be "resilient" and willing to work a lot of overtime.

The jobs are only open to Austrian citizens, all of whom will either have to be vaccinated against or fully recovered from COVID.

As we previously highlighted, the unvaccinated in Austria could find themselves imprisoned for a year under a new administrative law that would force them to pay for their own internment.

Austrians who don't get vaccinated by February face fines of up to €7,200 ($8,000) for non-compliance, and those who refuse to pay would also face a 12 month jail sentence.

END

UK

idiotic!!

(Watson/SummitNews)

Absurd New COVID Rules Fine People For Going To Work, But They Can Go To The Pub

Authored by Paul Joseph Watson via Summit News,

The absurdity of new COVID rules introduced in Wales was exposed after it was confirmed that people can now be fined for showing up to work but are still free to go on pub crawls.

"No person may leave the place where they are living, or remain away from that place, for the purposes of work or to provide voluntary or charitable services," states new guidance issued by the government.

Those who flout the new 'work from home' rules, introduced in the name of stopping the spread of the Omicron variant, face fines of £60 for each infraction, while companies could be hit with fines of up to £10,000.

While workers will be punished for showing up at the office, they will be free to get drunk in a packed pub at Christmas and on New Years Eve.

"From Monday, Welsh residents will be liable to a fine of £60 if they go to work in their office. They may, however, legally spend all day in the pub," Conservative MP for Clwyd West David Jones tweeted.

Jones questioned how police would even determine if a person could work from home instead of going to the office, since arguments for the necessity of being on site at the workplace are abundant.

"The Welsh Govt's approach to public health is unusual," he added. "You can't go to work but can sit in Wetherspoon's all day. You can't watch a football match from an open-air stand but can watch it on TV in a crowded bar. Are there some peculiarly antiviral properties that prevail in pubs?"

Meanwhile, in Scotland, visitors to nightclubs have been told that they must keep a distance of one meter away from the nearest person at all times, something that is virtually impossible on a crowded dancefloor.

This follows a recent update of the rules in Ireland, where authorities confirmed people didn't have to wear face masks on the dancefloor but would have to wear them if they left the dancefloor to go to the bar or the bathroom.

And if you're wondering how any of this makes sense, don't waste your time, because it doesn't.

The entire process appears to be just more social engineering to enforce compliance with rules and regulations that deliberately become increasingly more asinine and bewildering.

end

ITALY//ENERGY CRISIS

Now Draghi, Prime Minister of Italy warns of the energy crisis facing Europe

(zerohedge)

Mario Draghi Says "Urgent Policy Action" Needed To Tackle Europe's Energy Crisis

WEDNESDAY, DEC 22, 2021 – 09:40 AM

European natural gas prices surged to new record highs this week as Goldman Sachs commodity analyst Samantha Dart explained the rally had been driven by declining flows from a critical Russian pipeline, nuclear outages in France, and cold weather across the continent.

On Tuesday, Dutch front-month futures gained 20% to close at 182 euros per megawatt-hour. On Wednesday, prices were slightly off the all-time high, trading around 178 euros.

On Wednesday, these parabolic moves to the upside prompted Italian Premier Mario Draghi to tell reporters at a year-end press conference in Rome that urgent policy action is needed to rein in Europe's energy-price crunch.

"The increase in energy prices requires urgent action, we can't wait.

"The EU Commission is working but we need to work at national level as well and support for families and businesses for gas price hikes will be there if necessary, as it seems, beyond what has already been decided.

"There are big producers and sellers of energy that are having fantastic profits. They will need to participate to support the economy, they too need to help families," Draghi said.

After months of dwindling Russian gas supply into Europe, Goldman's Dart told clients this week that volatile gas prices are primarily due to the Yamal-Europe pipeline, one of the major three routes that Russia's Gazprom supplies gas to north-west Europe, dropped to zero "for the past four days."

The latest rise in energy costs are rolling onto households and businesses across the continent adds to inflationary pressures. Draghi is eager to introduce support packages for "families and businesses" because if governments can't resolve the energy crisis, a wave of discontent might follow.

We explained on Tuesday that Europe's energy crisis is worsening, and power prices are smashing records. It's only a matter of time before politicians enact support packages to partially or fully shield consumers from dramatic energy inflation. The reason behind such a move is politicians want to get re-elected.

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

end

TURKEY

Zero hedge explains how the central bank rescued the lira with a slight of hand. This will end in failure

(zerohedge)

Here's How Erdogan Launched His Lira "Rescue" Plan, And Why It Spells Doom For Turkey

WEDNESDAY, DEC 22, 2021 – 11:25 AM

Earlier this week, we dubbed Turkey's unprecedented, bizarre intervention in the FX market Erdogan's "Whatever it takes" moment in homage to Mario Draghi's similardeus ex machina, and according to a Reuters report, this is more or less exactly what happened.

As a reminder, almost a decade ago when the euro was collapsing and was widely viewed as reaching parity with the dollar in the near future, then-ECB president Mario Draghi unveiled his "whatever it takes" pledge to keep the Eurozone from falling apart due to the extreme widening of sovereign spread during the debt crisis. Indeed, even though Draghi's words birthed the OMT facility, the ECB has never had to invoke it.

Now, according to Reuters, something similar took place late last week when the Turkish lira was cratering every single day in response to Erdogan's crazy economic theories (where lowering rates is somehow expected to reduce inflation). It was then that Turkey's Treasury was working on "an ambitious but risky plan" to reverse a crash in the currency that would only be launched if it crossed the "absurd" threshold of 18 to the dollar, according to four people with knowledge of discussions, a threshold which was reached just days later.

The team of Treasury bureaucrats decided that lira depreciation beyond that level – which would damage the economy in ways that are "hard to repair", one senior Turkish official told Reuters, so they needed a scheme to avoid that if needed.

According to sources, the idea –to provide a government guarantee against FX losses on lira deposits, which is as ridiculous as it sounds as it merely shifts the risk to the government balance sheet– was also floated in the midst of the last currency crisis in 2018, but it was shelved at the time due to risks. This time the risks – which have already sent Turkey's CDS blowing out – were seen as acceptable.

Among the measures Erdogan announced in response to the recent Lira volatility, are:

- A new Lira deposit instrument that will compensate depositors for losses from Lira depreciation. If the loss from Lira depreciation is higher than the interest gain on the deposit, the difference will be transferred to the depositor and will not be subject to withholding tax.

- The TCMB will offer Lira forward rates to exporters having pricing difficulties due to the exchange rate volatility.

- The withholding tax on returns from domestic government bonds will be removed. The withholding tax on corporate dividends will be reduced to 10%.

- Exporters and industrialists will be given a corporate tax discount of 1pp.

- The state contribution to the personal retirement system will be increased to 30%.